After your Chapter 7 bankruptcy discharge, you embark on a new journey of rebuilding your life. There’s no shortage of resources for rebuilding credit, but the support given to those just coming out of Chapter 7 bankruptcy is far less accessible.

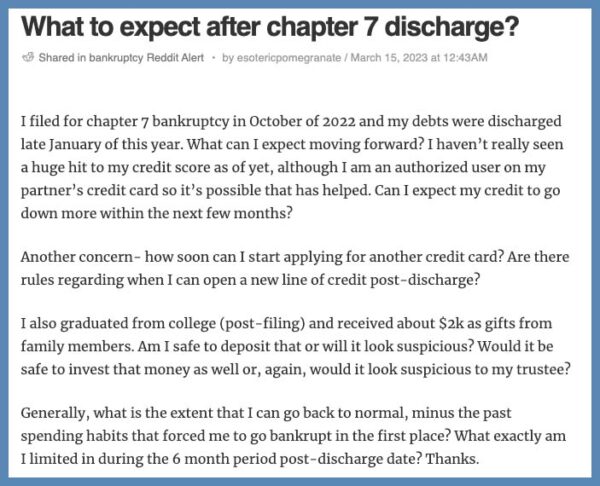

To help my bankruptcy clients succeed in their post-discharge world, I often help navigate the unique impact of bankruptcy on their credit scores, finances, and emotional well-being. This now-deleted Reddit post shows that not every bankruptcy lawyer provides the same support to their clients, so I thought it would be useful for me to share my advice. For context, here’s the Reddit post:

The Impact on Your Credit Score

Most people expect their credit score to plummet after filing for Chapter 7 bankruptcy, but that’s not necessarily true. The impact of bankruptcy on your credit score will vary depending on your situation. For example, if you had bad credit when you filed for bankruptcy, then it’s likely the damage was already done.

In that case, your credit score might even increase after bankruptcy. A 2014 report from the Federal Reserve Bank of Philadelphia confirmed this fact when it found that the average credit score among those filing for Chapter 7 bankruptcy increased by more than 80 points between filing their case and discharge.

Even if there is a significant drop in your credit score, it may take a few months to show up as the information regarding your bankruptcy continues to be reported to credit reporting agencies.

However, the good news is that you can start rebuilding your credit after your bankruptcy is discharged. A 2015 report from the Federal Reserve Bank of New York compared the credit scores of people who filed for bankruptcy with those who struggled with overwhelming debts, finding that the bankruptcy debtors experienced a sharper boost in their credit score than those who did not go bankrupt.

Applying for a New Credit Card

After hiring me, one of my clients’ first questions is when they can apply for a new credit card. Though there is no waiting period to apply for a new credit card after Chapter 7 bankruptcy, it’s important to approach this carefully. Remember that debt brought you to bankruptcy in the first place, so it’s a good idea to live without credit cards until you’re re-established your financial stability.

Pay your bills on time. Open a savings account and make regular deposits to build a financial cushion. Finish paying any debts that may have survived your bankruptcy. Cut your monthly expenses so you aren’t just living within your means but also leaving room for sudden price increases in your budget.

Once you feel ready, consider applying for a secured credit card. These cards require a deposit, which will act as your credit limit, and are typically easier to obtain after bankruptcy. Over time, responsible use of a secured card can help improve your credit score, potentially leading to an offer for an unsecured card.

Money or Property You Receive After Bankruptcy

The Reddit post raises the question of whether money received as a gift after filing for bankruptcy is safe from the bankruptcy trustee. Such a gift is considered “after acquired property,” or an asset obtained after filing your case. The bankruptcy estate is created upon filing, encompassing all your property and assets as of the filing date. After acquired property, however, isn’t included in the bankruptcy estate.

Under the U.S. Bankruptcy Code, the trustee can’t take assets and property acquired after filing for Chapter 7 bankruptcy. There are some limited exceptions for inheritances, life insurance proceeds, or property settlements from a divorce received within 180 days of filing, so it’s worth a quick call or email to your bankruptcy attorney to ensure your gift doesn’t fall into one of those categories.

So long as the money or property isn’t classed under one of the exceptions, you should be able to deposit, invest, or spend it as you see fit.

Fresh Start, New Opportunities

Filing for bankruptcy can be a challenging experience, but it’s also an opportunity for a fresh financial start. The road to financial recovery after bankruptcy is about establishing healthy spending habits and rebuilding your credit. As you move forward, focus on budgeting, saving, and avoiding debt whenever possible. This will help you regain control of your finances and ensure long-term financial stability. By focusing on responsible financial habits and rebuilding your credit, you’ll be well on your way to a brighter financial future.

Are you considering bankruptcy and need guidance? Set up a free 15-minute call with me to see if bankruptcy is the right solution for you. We’ll explore your options and work toward a more secure financial future.

ABOUT THE AUTHOR

Meet Jay

Since I became a lawyer in 1995, I’ve represented people with problems involving student loans, consumer debts, mortgage foreclosures, collection abuse, and credit reports. Instead of gatekeeping my knowledge, I make as much of it available at no cost as possible on this site and my other social channels. I wrote every word on this site.

Since I became a lawyer in 1995, I’ve represented people with problems involving student loans, consumer debts, mortgage foreclosures, collection abuse, and credit reports. Instead of gatekeeping my knowledge, I make as much of it available at no cost as possible on this site and my other social channels. I wrote every word on this site.

I’ve helped thousands of federal and private student loan borrowers lower their payments, negotiate settlements, get out of default and qualify for loan forgiveness programs. My practice includes defending student loan lawsuits filed by companies such as Navient and National Collegiate Student Loan Trust. In addition, I’ve represented thousands of individuals and families in Chapter 7 and Chapter 13 bankruptcy cases. I currently focus my law practice solely on student loan issues.

I played a central role in developing the Student Loan Law Workshop, where I helped to train over 350 lawyers on how to help people with student loan problems. I’ve spoken at events held by the National Association of Consumer Bankruptcy Attorneys, National Association of Consumer Advocates, and bar associations around the country. National news outlets regularly look to me for my insights on student loans and consumer debt issues.

I’m licensed to practice law in New York and California and advise federal student loan borrowers nationwide.

continue reading